Dear Clients,

The stock market was highly volatile in the first quarter of 2022. The rising interest rates and Russia’s invasion of Ukraine were the two main drivers behind such volatility. At one point, the S&P 500 and the Russell 2000 were down over 10% since the beginning of the year, while the NASDAQ was down almost 20%. Our portfolio * proved to be resilient, dropping much less than these indices, as we would expect from companies with low valuations and sound fundamentals. The stock market has since rebounded strongly from the lows, especially the NASDAQ. By quarter‐end, these major indices, as well as our portfolio, were down in the single digits.

In our last newsletter, we discussed that, given how strong the economy was, the Federal Reserve had clearly turned more hawkish and the 10 year Treasury yield could move above 2.5%. Since then, the 10 year yield has quickly jumped from 1.8% to 2.8%. This sharp increase in rates exerted pressure on certain stocks, especially the highly speculative ones (which we also discussed in length in the last newsletter). Where the rates will go from here isn’t nearly as clear. However, we believe many of the speculative stocks have more room

to fall.

In February, Russia invaded Ukraine. This attack not only grossly violated the principle of sovereignty and territorial integrity, but also caused tremendous human suffering. First Wilshire has two employees who grew up in the region, and this war has been especially personal and surreal. From the investment perspective, we do not have direct exposure to Russia or Ukraine in any of our strategies. This is partly because we’ve always recognized the risk existing in the region. In 2014, to further our understanding of Eastern Europe, two members of our investment team, Scott Hood and Feliks Zlochisty, visited both Russia and Ukraine. This was just months after the annexation of Crimea. In Ukraine, we met with numerous publicly-listed companies, as well as other important contacts. We also visited the Maidan Square in Kyiv (see the picture on the last page), where the Ukrainians had protested against the pro-Russia President Viktor Yanukovych, which eventually led to his ouster. Overall, the trip was a valuable learning experience: visiting in person and interviewing the locals often provide fresh perspectives. The publicly-listed companies we visited were trading at low valuations, but nevertheless, they were not worth the risk. We decided it was prudent to simply observe from a distance: We’ve had minimal exposure to the region over the years across all of our investment strategies.

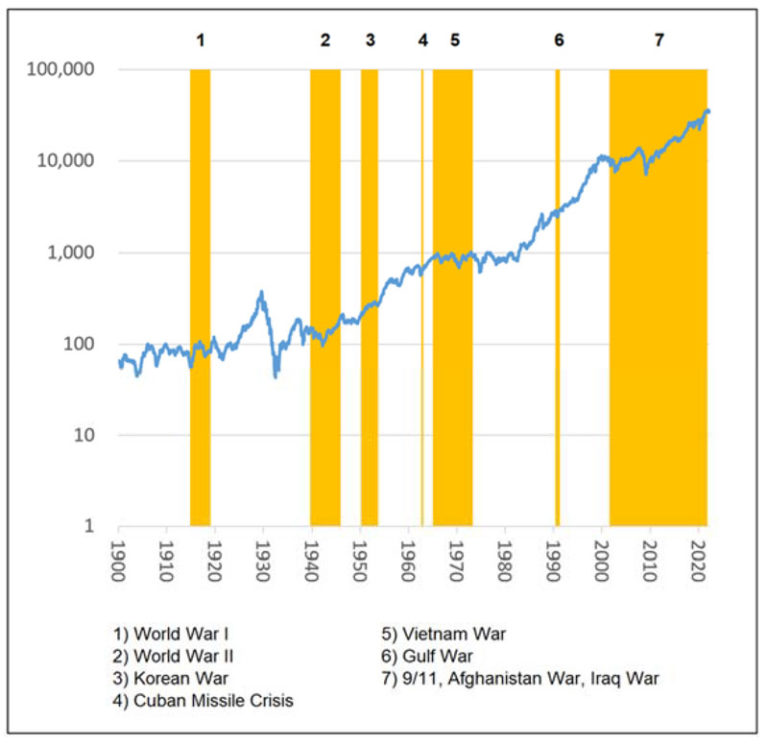

The war in Ukraine, however, will have implications far beyond the region, for many years to come. Russia, despite being only the 10th largest economy in the world, is a huge energy and agriculture exporter. The war, and the subsequent sanctions and reactions, will negatively affect the global economy and introduce unpredictable risks. However, we don’t believe wars in general have the doomsday impact on stocks, as is commonly feared (In fact, one may be surprised to learn that the stock market has actually gone up from Russia’s invasion in late February to the quarter-end). Many clients have asked us about the war in Ukraine, so we’ll explain our point of view in this newsletter. First, a little historical perspective. Below is a chart of the Dow Jones Industrial Average since the year 1900, overlapped with the major wars and crises that the United States had been involved in (Note that it’s plotted on a logarithmic scale; otherwise, you won’t see the fluctuations in the earlier years Dow Jones was in the 100s in the 1940s).

Overall, it is difficult to discern any significant correlation between wars/crises and stock market performance. The exception may be World War II, which actually drove the stock market higher because it brought us out of a recession. Despite all these armed conflicts, the American economy and the stock market have powered ahead. Of the major market crashes in the past – Wall Street Crash of 1929, Recession of 1937-1938, 1973–1974 stock market crash, Black Monday in 1987, the burst of the dot com bubble, the financial crisis of 2007–2008, the pandemic induced crash in 2020, etc. – almost none of them had to do with wars. How is it possible that these wars, which caused terrible human suffering, had such little impact on the stock market? We believe there are a few key reasons.

First, the United States is uniquely powerful and protected. Wars mean different things to different nations, and few can handle wars like the U.S. can. We are protected by the Atlantic Ocean and the Pacific Ocean and have friendly neighbors who are much less strong. In addition, we possess the largest and the most dynamic and innovative economy in the world. We also have the most advanced military with strategic alliances in key regions. The list goes on and on. These advantages range from deeply entrenched to permanent. While other countries are in tough neighborhoods where violence occurs from time to time, we live in a mansion with an ocean view. A tsunami in another part of the world becomes manageable waves when it reaches our shores. There were only a few times when our homeland came under assault since 1900 (most notably, Pearl Harbor, the Alaskan Aleutian Islands, and 9/11). Compare these events to what’s happened in Ukraine many thousands were killed so far, over 4 million have fled the country, and another 6 plus million were displaced within the country (out of a population of 44 million). Many other countries have also experienced similar calamities in recent history. Life is truly unfair and it’s no exaggeration that we’re the luckiest 4% of humanity.

Second, the ultimate driver for stock performance is economic fundamentals. Interest rates and investor psychology also play key roles, but the earnings of individual businesses are what truly matter over time. Whenever investors confront a scary headline such as a war, they should always stop to think about: How has this changed my behavior as a consumer? Will this have an impact on the earnings power or assets of the businesses that I own (either directly or through stocks)? If so, is it temporary or permanent? The Russia-Ukraine war does have an impact we already feel it at the gas pump, for example. Moreover, the war could take a turn for the worse. However, the damage to many businesses may not be as significant as initially imagined. And even if the situation worsens, our economy will eventually bounce back. For most businesses, what truly affects them is competition and innovation, not wars.

Third, when a large-scale armed conflict occurs, stocks become relatively attractive investments. This may seem counterintuitive. When a war escalates, it may very well depress stocks in the short term, as fear sets in.

Key Statistics

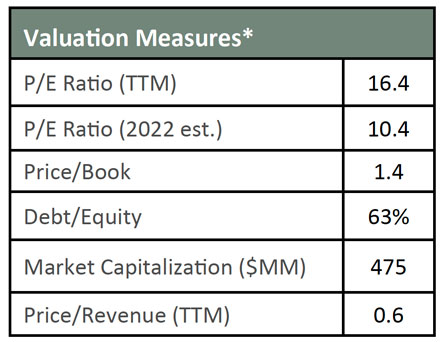

As of 3/31/2022, our top 30 positions traded at a discount to the major indices, with an estimated median P/E of 10.4 for 2022 versus higher estimated P/Es for the S&P 500 at 20.0, NASDAQ-100 at 26.2 and Russell 2000 at 23.3. The chart below is an overview of key valuation measures of the Separately Managed Accounts Composite as of 3/31/2022.

*Figures in the table above are median of the top 30 stocks of the aggregate portfolios on 3/31/2022 (individual portfolios may not have the same stocks or concentration). “P/E (TTM)” is price divided by the EPS for trailing twelve months. “P/E (2022 est.)” is price divided by 2022 earnings estimates. Source of estimates is Bloomberg or First Wilshire; some estimates are not available. All other figures are the latest available data at quarter-end.

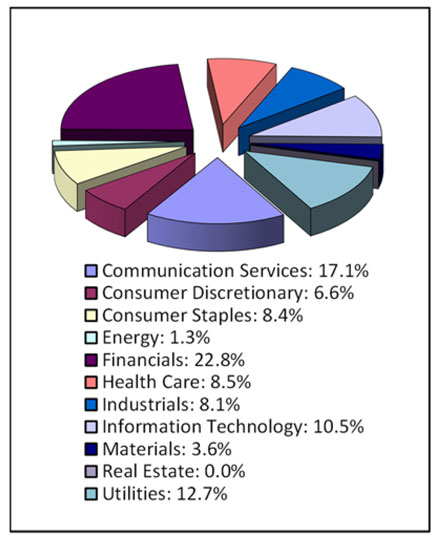

Sector Allocation

**As % of invested portfolio, using Global Industry Classification Standards. (GICS). Source: Bloomberg

However, if the U.S. should engage in a major conflict, our government will have no choice but to spend even more money on defense. If you think our government has a habit of spending beyond its means and leading us to inflation and currency depreciation, imagine what a major war would do (as a frame of reference: the U.S. debt-to-GDP went from 48% in 1942 to 119% in 1946**, mostly due to World War II). In such a scenario, investors may be well served to stock to investments that could potentially keep up with inflation, rather than being hurt by it. Reasonably strong businesses can keep pace with inflation because they can ultimately raise prices (whereas bonds and cash don’t provide such flexibility). When consumers pay more for products and services, a strong business in the supply chain can get its share.

These are the main reasons why we believe wars, while tragic, have failed to significantly impede the progress of the American economy and stock market. Of course, it doesn’t mean we simply remained static when the Russian invasion occurred. As with any significant event, there will be winners and losers as a result. Some businesses are hurt by the war, while others are immune or could even benefit (for example, defense contractors). We’ve made changes in the portfolio that we believe are warranted. As new developments occur, we will again act as appropriate. It’s important to keep in mind that investment decisions have to be made on a case-by-case basis because each stock has its own unique situation. As we were writing this newsletter, one of our top 10 positions, Antares Pharma, received a buyout offer that sent its stock up almost 50% in a day. It is a company that develops in-home, self-administered drug injection systems and rescue pens. During the Covid-19 pandemic, its business received a strong boost as people stayed home more. But when the pandemic began receding, investors believed these businesses would go away, sending its stock down. However, as we investigated further, we believed many patients would continue to use its technology after seeing the convenience and the reliability it provides. In other words, this is not just a pandemic stock, but a stock whose fortune has been fundamentally changed by the pandemic. How did the war change our investment thesis? We struggled to think of any impact whatsoever. In the end, another pharma company agreed with our assessment and decided to buy the company at a sizable premium. We believe there are always opportunities to be discovered in the small‐cap space, almost regardless of the macroeconomic environment. That’s largely because there are thousands of companies to choose from at any moment, and their stock prices can sometimes fluctuate wildly, presenting us with opportunities. The war has not dampened our enthusiasm to find the next bargain. Not in the least.

Thank you for your continuing trust. We would also like to acknowledge our new clients who recently joined us amidst the market volatility. Welcome aboard.

Sincerely,

First Wilshire Securities Management, Inc.

First Wilshire “On the Road”

During our visit to Kiev, we toured Maidan Square, the site of the violent protests against the then-president Viktor Yanukovych, who tried to steer Ukraine into the arms of Russia, against the will of the people. The square had recently been a war zone and still looked like it. Although the protests had occurred months ago, the camps and their inhabitants remained. The roads entering the area were blocked by tires and bricks, manned by a group of volunteers dressed in army fatigues. Pictures of all those killed or missing were everywhere you looked. There was just this sadness in the air. Our guide pointed out the bullet holes in trees and signs, the locacations where the snipers hid, and the main areas of conflicts. She broke down crying a few times. We walked quietly looking at everything, trying to be respectful and feeling we didn’t have the right to be there. From talking to many Ukrainians, it was clear then that these were tough people ready to defend their freedom at all costs. We learned a lot on that trip, and as we continued to follow Ukraine closely, we had hoped life would get better for them. We can only hope that time will come soon.

This picture was taken at an investment conference in March. It was strange to return to the first large‐scale small‐cap investment conference since Covid‐19 hit. Thousands of people were in abundendance and nearly 400 publicly‐listed companies presented. We saw dozens of people we had not seen or talked to in years, and it was especially helpful to meet with management again in person. Our main objective for conferences such as this is to find companies that have great potential, trade at relatively low valuations, and are run by competent and trustworthy management. Having hundreds of companies in one location is not a bad place to start. It’s a process of gradual elimination. Very often what appeared to be a promising stock became ordinary upon closer examination. Many stocks are cheap for a reason. But once in a while, an idea comes to fruition and makes all the effort worth it. Even when we don’t end up buying a stock, the knowledge we have gathered during the investigation is valuable. We came away from the conference with a few good ideas. For one of the companies we liked, we toured its factories after the conference. The pursuit continues.

A Message from Client Services

Is charitable giving important to you? Giving appreciated securities to charities can potentially minimize capital gains taxes and increase the amount received by those charities. If you would like to learn more about charitable giving, contact our Client Services team and we will set up a call with a member of our investment team to discuss. You may contact us directly at 626‐796‐6622 or clientservices@firstwilshire.com.

Thank you,

Client Services

This report is for informational purposes and is not a solicitation or a recommendation of any issuer or its securities. Additionally, this report should not be deemed as a research report and no investment decisions about any particular security or issuer should be made exclusively based on the information and content contained in this publication. First Wilshire Securities Management, Inc. (“First Wilshire” or “FWSM”) is an independent registered investment adviser with the Securities and Exchange Commission. First Wilshire claims compliance with the Global Investment Performance Standards (GIPS©). FWSM’s compliance with the GIPS© standards has been verified for the period from 12/31/1996 to 3/31/2017 by Ashland Partners & Company LLP and from 4/1/2017 to 12/31/2020 by ACA Performance Services, LLC. In addition, a performance examination was conducted on the Separately Managed Accounts Composite beginning 12/31/1986. A copy of the verification report is available upon request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Separately Managed Accounts Composite includes all separately managed accounts that FWSM has an investment management agreement with. This composite typically, but not exclusively, invests in small capitalization, U.S.-listed stocks. The composite was created in December 1986. The benchmark is the Russell 2000® Index, which is a market cap-weighted index and measures the performance of the 2000 smallest companies in the Russell 3000 Index. The firm maintains a complete list and description of composites and a compliant presentation, which are available upon request (Please contact Client Services at 626-796-6622). The U.S. Dollar is the currency used to express performance. Past performances of stock markets, as well as those of FWSM’s client pofoolios or any individual securities, may not be indicative of future results. Investments, including First Wilshire separately managed accounts, offer the possibility of loss. In general, smaller capitalization equities are considered riskier than larger capitalization equities due to, among other factors, lower trading volume and less financial resources. In fact, past performance should be only one of many considerations in selecting an investment manager. Please do not make investment decisions based solely on past performance. ADV II available on request and should be reviewed prior to investing.