We operate in an area of the market much better suited to active management. There are far more companies to sort through and much less information is readily available. We are true active investors performing in-depth research from the bottom up. Each position is owned because we believe it offers superior upside potential, often coupled with lower operational downside risk. Many of our portfolio companies are not in a major index and this exclusion breeds a majority of the most undervalued companies. We don’t spend any time considering the index components when assembling our portfolios, though we pay attention to stocks that are likely to go into an index or out of an index.

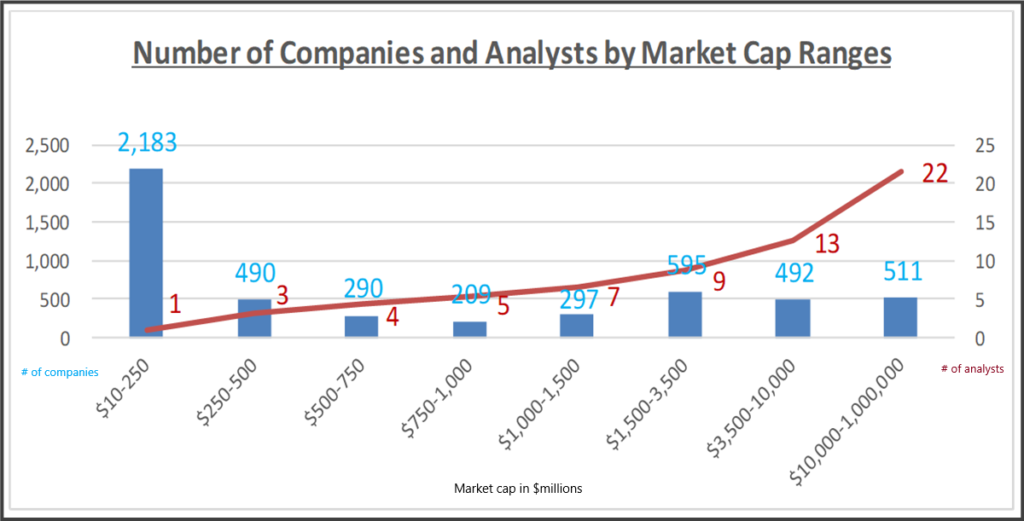

Funds will be forced to buy it or sell it as it is added or taken out of an index which can cause disruptive pricing that we can take advantage of. In addition to this massive flow of funds into index funds, the drop in analysts publishing research on stocks continues to decline. It appears this trend will continue with research investment company budgets expected to be cut again this year. We conducted our own analysis to see how many analysts are currently writing research on companies at different market cap levels. As you can see, there is very little analyst coverage in small and micro-cap stocks.

Source: First Wilshire Securities Management

For the companies between $10 and $250 million in market-cap, there is only an average of 1 analyst per company. Below $1 billion the average number of analysts is between 1 at the small end and 5 for the stocks near $1 billion.

Many companies have no published analysis at all. Fewer publishing analysts mean there is simply less attention being paid.

These companies may do very well but investors simply may not notice. Still, we consider this inattention to be a net positive, as it increases our opportunities to find undervalued stocks. Of course, after we buy them, we need others to take notice and move the stock higher. The factors that allowed us to buy it cheap may also require us to be more patient for its value to be discovered by other investors. We are happy to wait if you are.