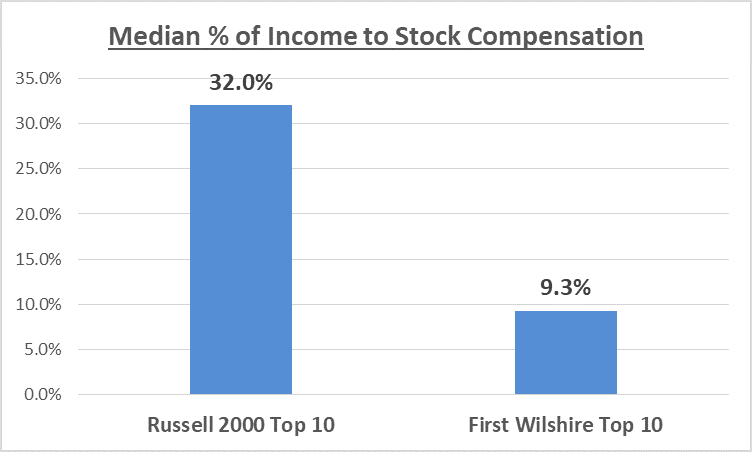

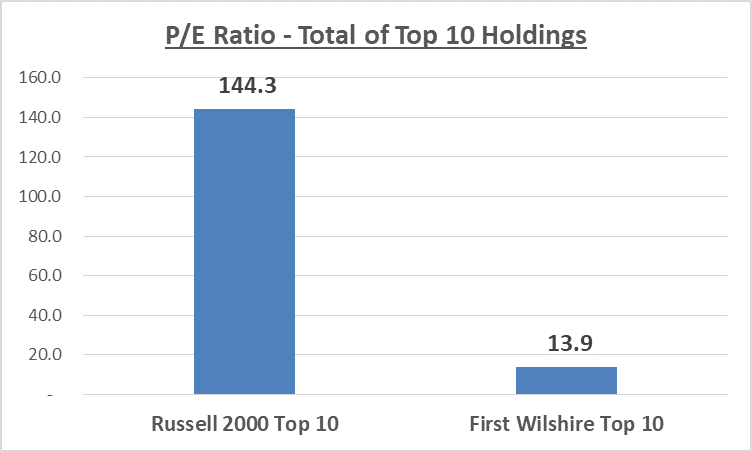

The top 10 Russell 2000 companies had a combined market capitalization of $66.1 billion, produce pre-stock compensation after tax profit of $815.8 million of which they paid out $357.5 mil in stock compensation (44%). The median stock compensation of the top 10 was 32.0% and trade at a price-to-earnings multiple of 144x. This is a very high valuation and not our cup of tea. The following charts are a median comparison of the top 10 stocks of the Russell 2000 versus First Wilshire’s portfolio.

The top 10 First Wilshire stocks have a median stock compensation payout of only 9.3% and trade at a P/E of 13.9. This goes some way to illustrating the favoritism of investors to growth stocks and why we believe our portfolio is better positioned for future performance. Of course, valuations have been similar for years now so mispricing can obviously last longer than expected and often longer than investors can hold tight. These figures should also at least serve as a warning to investors in the major index funds and index ETFs.

Source: Reuters/Eikon data. Figures represent stock compensation as a percentage of after tax net profit plus stock compensation.

Source: Reuters/Eikon data. Figures represent total market capitalization divided by total after tax net profit.